you guys talking vickie are talking vanilla right? vickie rev has a different economic model IIUC.

Announcement

Collapse

No announcement yet.

What have games taught you?

Collapse

X

-

So, Ben, in the real world, if a new baby is born, a certain amount of money is being printed and then handed out to that baby? Or for every adult, there so much money printed and handed out each month?`You explained a lot of money flows, but not, where the money originates, really. In Vicky, it seems like it comes out of no-where and, most importantly, the new money is interest-free (except when it is created by loans, which in RL it always is).

I will bring this to the point, now: In RL, money is printed by the respective national (or today, sometimes: supranational) central banks, and then loaned to either private people (via business banks) or the governments. In any case, money is created via debts. And only via debts. This means, that total supply of money = total amount of debts. In fact, the former is actually always lower than the later, since the new printed money had interest on it, for which to pay, no extra-money is being created (at first at least). So, ultimately, the question is not, if someone has debts, but rather, who has it, since someone got to be in debt. The sum of all states and pops must have a negative balance. If everybody tried to pay off his debts, all money would vanish, and still there would be debts. Since that is clearly not the case in Vicky, the model is not realistic.

Sidenote: Since the interest on new money is not created with that new money, there is always the need for more money (on average, not neccessarily in every single period, for sometimes more debt may be paid than new loands needed), whenever those interest are due (on aggregate). Thus the money supply is growing all on its own, without any need for a parallel population (or even production) growth. It is my understanding, that today we produce so much BS, just because we want to have production keep pace with the autonomous growth of money, so that prices stay stable.

And being able to push the taxes to 100% is about as realistic as ´Kaiser´ (german c64-classic, from 1984, where one optimal move was to set income taxes to 99%).

EDIT: Lord of the Mark, i play revolutions, but the issue persists.Last edited by Unimatrix11; January 23, 2009, 07:34.

Comment

-

I have learned that the worst side of people come out over the internet due to the anonymous nature of human interaction in that realm.*"Winning is still the goal, and we cannot win if we lose (gawd, that was brilliant - you can quote me on that if you want. And con - I don't want to see that in your sig."- Beta

Comment

-

Wealth is very much related to population growth, as we are about to find out in the real economy.So, Ben, in the real world, if a new baby is born, a certain amount of money is being printed and then handed out to that baby? Or for every adult, there so much money printed and handed out each month?`You explained a lot of money flows, but not, where the money originates, really. In Vicky, it seems like it comes out of no-where and, most importantly, the new money is interest-free (except when it is created by loans, which in RL it always is).

Nonsense. Wealth is created by labour done to satisfy demand. I've heard the debt theory, but there is no debt without demand. You can make all you want, but it won't have any value to anyone unless there is demand. Same with debt. Unless people have a need for something, they will be unwilling to contract for debts.I will bring this to the point, now: In RL, money is printed by the respective national (or today, sometimes: supranational) central banks, and then loaned to either private people (via business banks) or the governments. In any case, money is created via debts. And only via debts.

The value of money means nothing without demand. Look at Zimbabwe. As soon as the businesses stopped accepting their dollar, the debts of Zimbabwe dropped to 0, as the currency became worthless. Clearly the wealth of the nation must be based on tangible assets, as there was still a functioning market economy, (just not denominated in dollars).This means, that total supply of money = total amount of debts.

Wrong, if everyone paid off their debts, the amount of money in circulation would not change.So, ultimately, the question is not, if someone has debts, but rather, who has it, since someone got to be in debt. The sum of all states and pops must have a negative balance. If everybody tried to pay off his debts, all money would vanish, and still there would be debts. Since that is clearly not the case in Vicky, the model is not realistic. That's the whole point of a 'money supply'. For the most part it is a fixed amount (slightly increasing) to compensate for money that is destroyed. Inflation is caused by two things. 1, an increase in the money supply (increase in the amount of dollars over demand), or an increase in demand over money (thereby increasing prices). Deflation is the opposite, either by shrinking the money supply (won't happen), or by a decrease in the demand over the amount of money, leading money to become more valuable and goods to become less valuable.

That's the whole point of a 'money supply'. For the most part it is a fixed amount (slightly increasing) to compensate for money that is destroyed. Inflation is caused by two things. 1, an increase in the money supply (increase in the amount of dollars over demand), or an increase in demand over money (thereby increasing prices). Deflation is the opposite, either by shrinking the money supply (won't happen), or by a decrease in the demand over the amount of money, leading money to become more valuable and goods to become less valuable.

The game isn't harsh enough on out-migration.And being able to push the taxes to 100% is about as realistic as ´Kaiser´ (german c64-classic, from 1984, where one optimal move was to set income taxes to 99%).Scouse Git (2) La Fayette Adam Smith Solomwi and Loinburger will not be forgotten.

"Remember the night we broke the windows in this old house? This is what I wished for..."

2015 APOLYTON FANTASY FOOTBALL CHAMPION!

Comment

-

They already are wealthier then Europe.If wealth were related to population growth, India and China would be rich beyond their wildest dreamsScouse Git (2) La Fayette Adam Smith Solomwi and Loinburger will not be forgotten.

"Remember the night we broke the windows in this old house? This is what I wished for..."

2015 APOLYTON FANTASY FOOTBALL CHAMPION!

Comment

-

Ben, the claim, that there would still be money, if everyone (tried to) pay his debts, his wrong. Plain wrong. Money is made by demand, alright. If it´s demanded for a proftiable enterprise, it will be granted and made, either directly by the CB or via the multiplication by the business banks themselves. On that money, that is freshly made by this process, there is interest. The money to cover that interest does not exist though. And interest cannot be paid with anything else. Not houses, pigs or sandwiches.

Take a simple example (taken from ´Wie funktioniert das Geld ?´ (´How does money work?´) from Max von Bock):

1 Planet,

10 Lifeforms,

100 Pieces of leather as currency

First, each lifeform gets 10 pieces of leather. Lended. As in RL. Interest rate: 10%. Now after one year, the total debt of the population is now 110 leather pieces, while only 100 exist. It doesnt matter, how much the 10 lifeforms produced within that year, unevitably, 10 leather pieces are missing, to cover the interest rate for the initial 100. This means: In year 2, another 10 leather pieces will be ´printed´, yet again with an interest attached to them, and again the 11th piece to cover the interest in the next year will be missing. The system comes to a life all on its own here and the population will be, for all eternity and absolutely disragarding its productivity, on aggregate, indebted. Now add compound interest. The debt will grow - exponentially. Where, do you think, do all these critical quotes about the banking system in civ (smith, jefferson...) come from?

One has to be carfull to stick with the terms btw.: Wealth != money. Wealth is indeed made by the population and should indeed grow with it. Not so with the money. That is created by banks, and it grows all on its own (because it is frequently demanded for reasons described above). It should grow with the wealth and in its pace, but it cannot always be limited to that grow. Since it´s own growth cannot be limited to zero, production has to constantly grow, at least with the rate of the money-growth. The adjustment, that should take place in the monetary sector, is taking place in the real sector instead. If there is no demand for the production, it must be created. That´s what marketing is for. Some econmics students are just funny. They claim, that production is always geared towards demand, and chant that mantra at any (im)possible occasion, but in the marketing course they learn the exact contrary and how to sell stuff, for which there is no demand.

What is ´demand´ anyways ? I mean, i´d like a yacht, but i am certainly not demanding it, esp. not for the price tagged to it. But if you´d give me one for free, i´d take it, and even would say ´thank you´. Is that demand ? Obviously demand, depends on the price. If i make crap, just cheap enough, i will create demand.

OKay, now how currencies can go bankrupt: The central banks my seem to some as the all-controlling behemoths of power, who are the only entities beyond competetion. Well, they are not. The currencies they emit, are emitted into a sphere of competition. Currencies compete. If one CB handles its currency and the supply of it unwisely, the currency´s value will start to drop, causing an inflation on it. Inflation either starts a run on the goods, or a run on another currency. If the later happens, the old currency will soon be out of business for good.

About how much money there is and how fast it grows:

In 1970, there were ca. 300 Billion D-Mark (M3), in 1980 there were ca. 770 Billion and by 1990, prior to unification, there were more than 1.300 billion. The numbers for M2 for the respective dates are: ca. 100B, ca. 250B and ca. 480B. Source: Deutsche Bundesbank, taken from ´Einführung in die Geldtheorie´, Ottmar Issing, page 11. Wether you want to call this increase ´slight´, i leave upto you, but i certainly dont. EDIT (hope it bumps): I´d call that growth exponential, instead (doubling roughly every 10 years).

But to bring this all back to topic somehow: I wish there was a game, that taught you that. People would be pretty boggled, i imagine. The forum for it would probably soon be spamed with mails like ´how do i win?´ and false bug reports about the game being not winable, really, bashing beta-testers for their poor balancing and stuff like that. In fact, this game, in its current version (and there have been others versions of it even long before it), is already going for 315 years (since the bank of england supplies the pound this way).Last edited by Unimatrix11; January 28, 2009, 09:12.

Comment

-

Money is just a function of exchange.

You don't even need a currency, in your example, the currency would actually increase in value every year, (to reflect the fact that it's worth more).

Let's take your example.

The bank lends out 10 bars of gold at the price of 10 leather strips each at 10 percent a year.

Strips can be made, while gold cannot.

After the first year, it is as you have said, they owe 10 bars of gold, but as they start to make leather strips, the price of the gold increases, and the strips drop.

No banker would ever lend the money out in your first example, because it's a closed loop.Scouse Git (2) La Fayette Adam Smith Solomwi and Loinburger will not be forgotten.

"Remember the night we broke the windows in this old house? This is what I wished for..."

2015 APOLYTON FANTASY FOOTBALL CHAMPION!

Comment

-

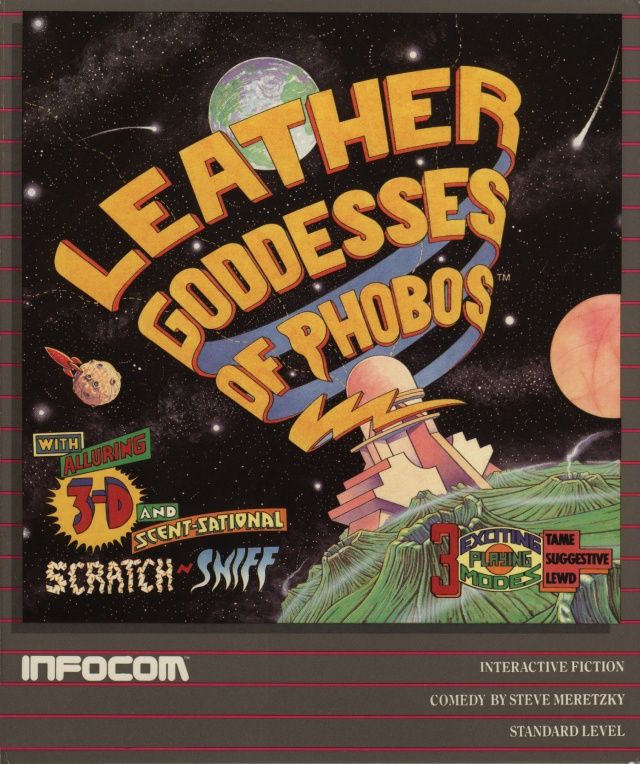

So erm.....we are saying 'games taught me about economics.....on planets that trade in leather' - would those planets include this one:

Comment

-

Fiat currencies are not based on gold or anything. Most (if not all) current currencies are fiat currencies.Originally posted by Ben Kenobi View PostMoney is just a function of exchange.

You don't even need a currency, in your example, the currency would actually increase in value every year, (to reflect the fact that it's worth more).

Let's take your example.

The bank lends out 10 bars of gold at the price of 10 leather strips each at 10 percent a year.

Strips can be made, while gold cannot.

After the first year, it is as you have said, they owe 10 bars of gold, but as they start to make leather strips, the price of the gold increases, and the strips drop.

No banker would ever lend the money out in your first example, because it's a closed loop.

Comment

-

What have games taught me?

There is always a way to get things done.

If what you're doing isn't working, try something else.

Other, more experienced players have tips and tricks that you can apply in your own game.

If you lose, try again, and you might find a way.

Cheating is for people who want to say that they won, not for people who actually want to win.

And all these lessons apply to life as well.

-------------------

-------------------

And that Mahatma Ghandi is one bloodthirsty, warmongering SOB

Any man can be a Father, but it takes someone special to be a BEAST

Any man can be a Father, but it takes someone special to be a BEAST

I was just about to point out that Horsie is simply making excuses in advance for why he will suck at Civ III...

...but Father Beast beat me to it! - Randomturn

Comment

Comment