Announcement

Collapse

No announcement yet.

What the Finns need to know about Portugal.

Collapse

X

-

Originally posted by Riesstiu IVPortugal is the West Virginia of the Romance language speaking nations.Originally posted by ThothBecause they are the Quebec of Europe

Same thing.

Innit?Libraries are state sanctioned, so they're technically engaged in privateering. - Felch

I thought we're trying to have a serious discussion? It says serious in the thread title!- Al. B. Sure

Comment

-

What does Portugal do besides exist?Life is not measured by the number of breaths you take, but by the moments that take your breath away.

"Hating America is something best left to Mobius. He is an expert Yank hater.

He also hates Texans and Australians, he does diversify." ~ Braindead

Comment

-

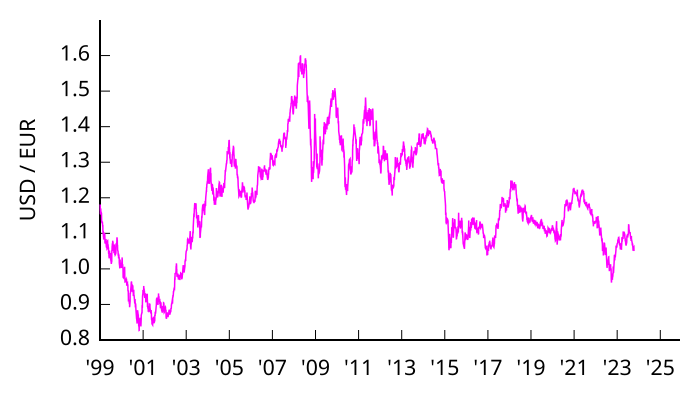

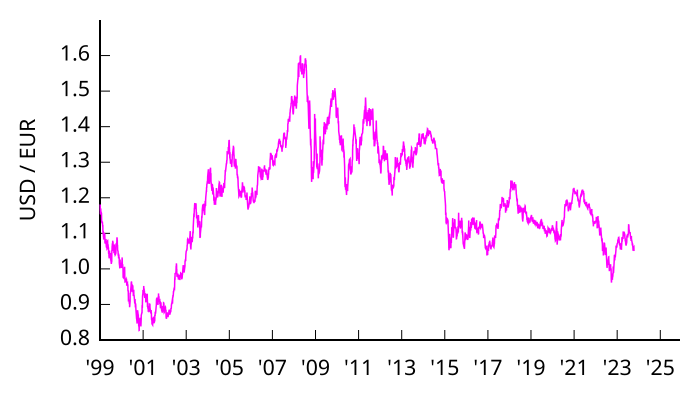

The trend is clear. After 6 years of consistent growth from ~0.9 in 02 to ~1.5 in 08, the USD/EUR ratio has declined from ~1.5 to ~1.30 from 08 to 11.Originally posted by gribbler View PostIMO, not much of a trend over the last couple of years here:

We need seperate human-only games for MP/PBEM that dont include the over-simplifications required to have a good AI

We need seperate human-only games for MP/PBEM that dont include the over-simplifications required to have a good AI

If any man be thirsty, let him come unto me and drink. Vampire 7:37

Just one old soldiers opinion. E Tenebris Lux. Pax quaeritur bello.

Comment

-

Yes, this is correct.Finland only has to aprove the bailout by financing 14 billion euros of it

An excellent question.Originally posted by KrazyHorse View PostThe real question is why others are willing to give it to them.

First, some simple facts, please to correct me when I'm wrong:

All governments fund their deficit spending by approving government bonds to private investors (people like you and me, who happen to have millions or billions to spend). In the free market, private investors are willing to loan money in return of a certain interest rate which depends on how the investors see the probability of a set pay-back to be. The % rate of bond interest is thus set up in private markets by the bond market. Government bonds usually hover around 3-6% in western countries, they are presumed to be one of the most trustworthy investments around. The risk of a government default on loans, ie. the probability of a chance that the government issuing the bonds couldn't have any money to pay back when bond matures, is what raises the interest rate of government bonds.

Portugal ran out of sources willing to give them any credit from the bond market few weeks ago. That is, their governmental budget deficits are so high that nobody (and, more importantly, debt as a % of GDP) in the free market is stupid enough to presume that they could ever pay anything back.

This is where politics comes in. EU leaders decided that other EU countries should give low-interest loans to Portugal since they can't get any loans from the free market, so Portugal wouldn't default on it's previous loans to the biggest banks which have been stupid enough to issue them loans during the past 5 or so years. It's a rather interesting viewpoint -- in order to protect largest corporations, government should intervene when there is a risk of corporations making losses because of their own mistakes in the past. So other EU countries which are still able to get low-interest loans from the bond market should take loans which would be then re-loaned to Portugal in order for it to pay for it's past loans. The size of this "aid package" would be 440 billion euros (http://forex.fxdd.com/80159/economic-statistics/eu-press-conference-on-loan-package).

What has Finland to do with all of this? Finland had elections on April 17th. A few weeks before that, the finance minister of the previous government, Jyrki Katainen, announced that the Finnish part of this loan package was to be 13,96 billion euros. This affected election results to some degree. Party leaders haven't yet agreed on what parties are in the next government, this very question has been confusing the governmental negotiations to some degree.

Regardless of what the next government will be, the Finnish part of the aid package needs to be accepted by the current parliament (199 voting members).

What should be done instead of a loan package financed by the other EU-governments (incl. Finland)?

Let's approach this question with a simple parable. You have a friend, Andrew. Your friend has a hot-dog business. You have loaned $900 000 for Andrew for his business. Andrew buys hot dog buns for $1 each and hot dog sausages for $1 each, then re-sells them for $3. Andrew sells 10 hot-dogs per day. Andrew also pays himself $50 000 salary per one day. Now Andrew, of course, has some little problems with his business. His business made a net loss, a deficit you might say, of $3 000 000 last year. He has a total debt of $15 000 000, and he loses $300 000 per month to debt interest costs. Given the facts you have heard of this case, is the correct alternative:

(a) Loan $900 000 more for Andrew so he can pay his interest costs from the next three months, surely his business will turn around any day now.

(b) Cover some immediate debts of Andrew, get in business with him and quarrel with him over how to run his business.

(c) Decide to stop giving any loans to Andrew, let him default all his loans (meaning nobody would give him any loans for a few years but he wouldn't drown in all the interest costs) so he can fix his mess, try another business and get his financial house in order.

(d) Force your other buddy, Charles who has had nothing to do with Andrew's business or your loans, to loan $2 000 000. Then loan another $4 000 000 by yourself. Appoint a committee to ponder how to solve the problem, pay them $280 000 per month. Announce that your loan-applying business is "too big to fail" and secure $12 000 000 from EU governments to Andrew to pay his debt interests for the next 12 months. Pretend that the problem is solved and wait for 12 months so the same crisis can re-start.Last edited by RGBVideo; May 10, 2011, 07:16.

Comment

-

good post VJ.

although in fact if it had been left to the 'free market' portugal would have sunk much, much sooner. there has only been one buyer of portuguese debt for a long time and that is the ECB. they have succeeded in creating a false market for portuguese debt, buying large amounts which has coincided with banks ridding themselves of almost the same amount of portuguese debt. quite apart from the irony of a central bank creating false markets, it is yet another another banking bailout. it exposes the banking system, despite all the lies we are fed about its health, for the house of cards that it is.

looking elsewhere in EU. we are now seeing a greek 'restructuring' being openly discussed, a year after its 'rescue'. there is even some hushed talk of an exit from the euro, although given the political stakes, you have to wonder how bad things are for this to even to be discussed seriously. ireland will not be too far behind."The Christian way has not been tried and found wanting, it has been found to be hard and left untried" - GK Chesterton.

"The most obvious predicition about the future is that it will be mostly like the past" - Alain de Botton

Comment

-

Apologies, had timescale wrong (1y, not 2y). What I'm referring to is the runup of the EUR over the last year, coinciding with the ECB's increase in headline rates, Trichet's relatively strong statements on the future stance of monetary policy, and the Fed's decision to engage in QE2.Originally posted by gribbler View PostIMO, not much of a trend over the last couple of years here:

If the ECB was "printing money" (relative to the Fed) to save the PIIGS (starting in May 2010 with Greek bailout) then the Euro would be declining in value against USD, not rising in value.

In actuality, what the ECB has been doing is intervening in the CREDIT market for shady government bonds (by e.g. accepting them as collateral for loans), not the market for money.12-17-10 Mohamed Bouazizi NEVER FORGET

Stadtluft Macht Frei

Killing it is the new killing it

Ultima Ratio Regum

Comment

-

I have only skimmed your post. Are you agreeing with me?Originally posted by VJ View PostKH, I'm eagerly waiting for your fact-check on all the obvious errors in both my post and the article above. Thx.12-17-10 Mohamed Bouazizi NEVER FORGET

Stadtluft Macht Frei

Killing it is the new killing it

Ultima Ratio Regum

Comment

-

I'm kind of confused, how exactly does this work/what is it? How can the ECB bail them out without actually buying their risky debt?Originally posted by KrazyHorse View PostIn actuality, what the ECB has been doing is intervening in the CREDIT market for shady government bonds (by e.g. accepting them as collateral for loans), not the market for money.If there is no sound in space, how come you can hear the lasers?

){ :|:& };:

){ :|:& };:

Comment

Comment